The fresh borrowing interest typically has a short-label negative impact on your credit rating. In the event that you apply for this new borrowing or take toward a lot more financial obligation, credit-rating options influence that you are greater risk of being in a position to spend your debts. Fico scores generally speaking drop a little while whenever that occurs, but rebound within a couple months providing you keep up with your bills. As a result of this factor, it’s a good idea in order to “rest” 6 months or more ranging from software for new borrowing-in order to stop beginning brand new profile on months before you can want to sign up for a major financing like a home loan otherwise a car loan. New-borrowing from the bank interest normally contribute up to 10% of your own total credit score.

Multiple borrowing membership produces borrowing-score developments. The latest FICO credit rating program does prefer people with multiple credit accounts, along with each other revolving borrowing (account including playing cards that enable you to borrow on a paying limitation and also make money from differing quantity per month) and you can payment financing (age.g., car loans, mortgages and student loans, having set monthly payments and you may repaired pay episodes). Credit mix makes up regarding the 10% of credit score.

42% Individuals with an effective 700 FICO Get provides borrowing portfolios that come with auto loan and you may 29% has actually a mortgage.

Public information including bankruptcies dont appear in most of the borrowing from the bank declaration, thus these entries cannot be compared to almost every other rating has an effect on from inside the fee terms and conditions. If an individual or more is actually listed on your credit history, it does surpass any other points and you may seriously reduce your borrowing rating. Such as for instance, a personal bankruptcy can stick to your credit history having ten years, and might closed your off accessibility many types of credit to possess far or all of that date.

The FICO Get are good, and you’ve got relatively a great probability of being qualified to own an extensive version of money. But when you is also alter your credit rating and ultimately visited ab muscles A (740-799) otherwise Outstanding (800-850) credit-get ranges, you can be qualified to receive most useful interest levels that save your thousands of dollars for the notice along the longevity of your funds. Here are couple actions you can take to begin enhancing your credit scores.

Look at the FICO Get on a regular basis. Record their FICO Rating provide an effective viewpoints since you strive to build-up your get. So you can automate the method, you can also consider a credit-keeping track of service. In addition may prefer to explore an id theft-coverage service that may banner suspicious pastime in your credit reports.

Avoid high borrowing from the bank application rates. Higher credit utilization, or loans utilize. Try to keep their utilization across all your valuable account less than regarding the 30% to cease reducing your get.

Search a strong credit blend. You must not accept financial obligation they won’t you desire, however, wise borrowing-in the way of rotating credit and cost fund-can also be promote a good credit score results.

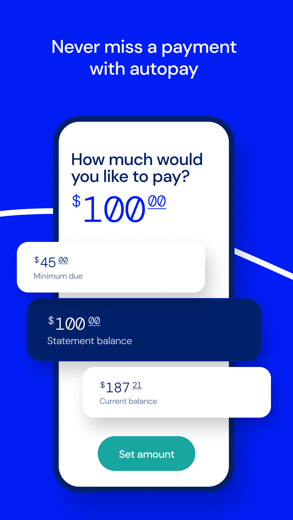

Spend your debts punctually. You’ve heard it in advance of, but there is however zero better method to boost your credit rating, thus see a network which works for you and you may adhere to it. Automatic systems eg cellular phone reminders and automated costs-commission features work for of numerous, sticky cards and you may report calendars, for others. Immediately following 6 months approximately, you may find oneself recalling in place of assist. (Hold the system going anyhow, whenever.)

An effective 700 FICO Rating is right, but because installment loan Memphis AL of the raising their get to your Decent diversity, you might be eligible for straight down interest levels and better borrowing words. A great way to start is to obtain your totally free credit history off Experian and look your credit score to acquire from certain matters you to impact your get many. Find out more from the get ranges and you can what good credit is.

Its dated but it’s a beneficial. Any other factors being the exact same, the brand new lengthened your credit report, the greater your credit rating almost certainly might possibly be. That does not assist much if the previous credit rating are bogged off by later costs otherwise higher use, and there is nothing can help you regarding it when you are an excellent the new debtor. But if you take control of your borrowing meticulously and maintain with your instalments, your credit rating will tend to boost over the years. Age of credit rating accounts for as much as fifteen% of your own credit rating.